The best AI platform for Insurance compliance.

The RegTech platform successfully used by financial institutions, insurance firms, SGRs and Asset Managers to simplify the work of corporate compliance teams, thanks to Artificial Intelligence.

Transforming compliance into a competitive advantage with Aptus.AI.

The Insurance market is highly regulated and the publication of regulatory updates is almost daily. This forces corporate compliance operators to analyze an incredible amount of legal documents in an ever-changing scenario.

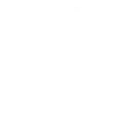

Aptus.AI was created as a disruptive answer to this need, by making regulations digitally accessible and analyzable, automating processes and allowing compliance professionals to focus on high value-added activities.

With Aptus.AI all the regulatory sources of the Insurance sector are mapped in real time.

The encyclopedia of regulations: all the issuers in a unique platform.

Navigate in a single point over 20.000 national, European and international regulatory documents, even before their entry into force and updated to the latest current version, specifically related to the regulatory framework for insurance firms.

- DORA

- Solvency II & IDD

- PRiiPs

- GDPR

- AML & CTF

- SFDR, NFRD, CSRD, Taxonomy & Benchmark Regulation

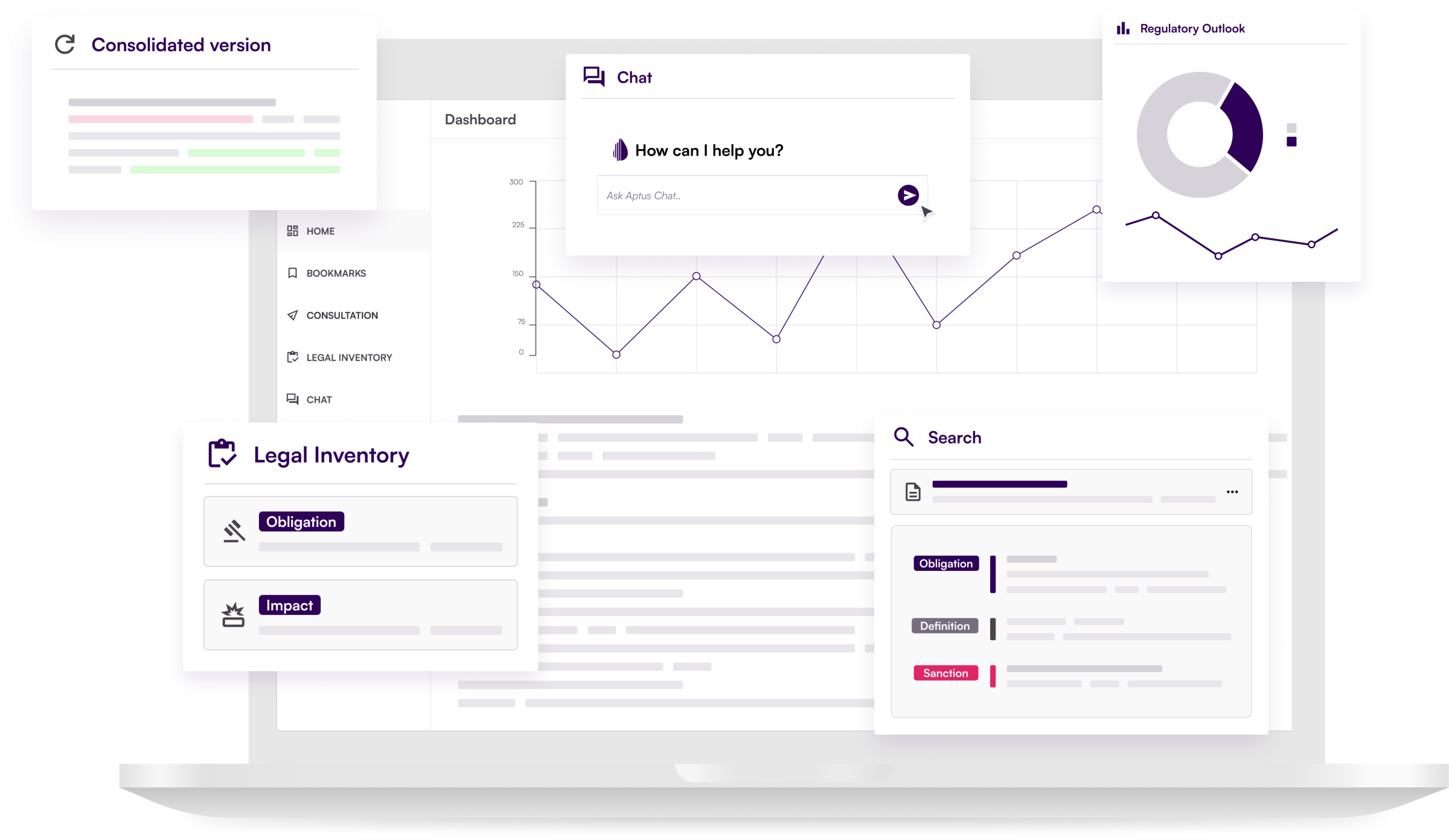

Our solution can be integrated into the different processes followed by compliance teams.

Regulatory

Sensing

We support companies in the process of regulatory analysis

Regulatory

Advisory

Regulatory Change

Management

We help companies simplify regulatory compliance

Compliance experts trust Aptus.AI.

Video-testimonies on how organizations use our solution to optimize compliance.

“Aptus.AI helps us transform everything analog in the world of compliance and control functions into digital"

Enzo Battaglia

“Aptus.AI helps us understand the new regulations that are coming into force and the impacts on internal regulations"

Luca Gandolfi

"Aptus,AI makes legislation more usable by making emerging regulations easier to identify, helping us analyze new risks"